Your Year-End Financial Checklist

As November arrives and the year begins its final act, thoughtful investors turn their attention to a different kind of preparation. While others are distracted by holiday planning and Black Friday sales, the financially literate consider whether there’s anything that needs tidying up in their financial life.

Most of the heavy lifting in financial planning happens in the big decisions you've likely already made. These small year-end actions separate good investors from great ones. They're the compound interest of good habits, the quiet discipline that results in peace of mind and financial security.

Before the year-end rush begins, here are five practical steps that deserve your attention in November.

Five Moves That Matter

The best investors know that great planning isn't built in dramatic moments but in consistent, thoughtful actions. Here are five year-end actions you can take to give you peace of mind during the holidays and help you to start 2026 on the right foot.

1. Review your insurance and beneficiaries.

November is the perfect time to check all your policies and accounts. The beneficiaries you named five years ago might not reflect your current wishes. On the slight chance that the insurer has made an administrative error, you’ll catch that too. This ten-minute review could save your family the headache of discovering an incorrect beneficiary nomination at claim stage.

2. Get your paperwork in order.

Nobody likes thinking about worst-case scenarios. Having your affairs in order brings peace of mind. Is your will current? Do your loved ones know where to find important documents? Think of this as creating a roadmap for those who might need it. Organisation today prevents chaos tomorrow. One afternoon of sorting could be the greatest gift you give your family.

3. Review your monthly subscriptions and debit orders.

Those small monthly payments have a sneaky way of multiplying. The streaming service you tried once, the gym membership you keep meaning to use, the insurance for the phone you replaced last year. Run through your bank statements and cancel what you're not using. You might be surprised how much you free up for next year's goals. Every pound saved is a pound that can work harder elsewhere.

4. Plan for major expenses.

Look ahead to 2026. What's coming that you already know about? A new car, home repairs, that memorable anniversary trip, university fees? Identifying these expenses now allows you to prepare properly rather than scrambling later. Set up a separate savings pot for each major expense. When the time comes, you'll pay with satisfaction rather than stress.

5. That one thing you've been avoiding.

You know what it is. It could be consolidating old pension pots, setting up that trust, or having the money conversation with your adult children. Whatever you've been putting off, November is your permission slip to tackle it. The relief you'll feel heading into the new year will far outweigh the discomfort of dealing with it now.

Small Actions, Big Impact

You don't need to tackle everything at once. Completing two or three of these items puts you ahead of most investors who let the year slip away without review. Choose the ones that resonate with your current situation and start there.

The fact that you're thinking about these matters while others are thinking only about Christmas lunch and shopping says something important about your financial maturity. You understand that small actions compound into significant results.

The financially literate don't need perfect execution. They need consistent attention to what matters. If you'd like help working through any of these year-end considerations, we're here to guide you.

Published 05.11.2025

2025 Budget Speculations

Here we go again.

After much speculation about what would be included in last year’s 2024 Budget, recent reports suggest significant changes await us in this year’s Budget.

If you accept what’s written as truth, the changes could affect anything from capital gains tax, inheritance tax, pensions and maybe even ISAs.

While investors are left wondering whether they should act now or wait, the good news is we’ve been here before. Last year, we faced similar uncertainty and widespread speculation about dramatic pension reforms, inheritance tax overhauls, and sweeping allowance reductions.

Our guidance was simple: wait for facts, not speculation.

How did that work out? Some feared changes didn't materialise, and others were less dramatic than predicted. Capital gains tax rates increased from 10%/20% to 18%/24%. Stamp duty surcharges increased from 3% to 5%. But the biggest actual change - pensions entering inheritance tax from 2027 - wasn't even widely predicted.

Investors who refrained from making quick decisions based on speculation experienced different outcomes than those who reacted to every rumour

This Year's Speculation

Current reports suggest the Treasury will be looking to find an extra £30 billion in tax rises.

The chancellor will be incentivised not to breach any manifesto pledges, and therefore income tax, VAT, and National Insurance appear to be safe from reforms.

This leaves room to generate the necessary revenue through adjustments to capital gains tax rates, pension reforms, changes to inheritance tax rules, restructuring of the ISA allowance, and various property tax adjustments. However, even this narrowed-down list does not provide enough information to base any firm recommendations on.

The same problem, therefore, remains. We don't know the details, timing, or even whether these changes will happen. Speculation often misses the mark while creating unnecessary anxiety. Political and economic realities change quickly.

Why "Wait and See" Is Still Sensible

Last year proved that reacting to speculation rather than facts typically leads to poor decisions. Waiting for official announcements means you can base decisions on actual proposals, understand the real impact on your situation, and avoid unnecessary complications.

For now, our recommendation is to focus on what you can control. Review your current arrangements to ensure you're using existing allowances and reliefs. Above all, we suggest avoiding significant changes based solely on media rumours.

Last year's patience served our clients well. This year, despite more intense speculation, the same principle applies.

When the budget is announced, we'll have facts to work with. Until then, patience beats panic, and facts beat speculation.

Published 13.10.2025

It's Never Too Late to Get Your Finances in Shape

Have you ever looked at your financial situation and felt that familiar knot in your stomach? Maybe you've been putting off organising those scattered investment accounts, or you know your savings rate (the amount you invest each month) isn't where it should be. Perhaps you've glanced at a friend's retirement balance and wondered how you fell so far behind.

If this sounds familiar, you're not alone. We see this every day in our business. The good news is that it's never too late to improve your financial position. No matter where you are right now, a few focused improvements can transform your situation faster than you might imagine.

Getting in Shape

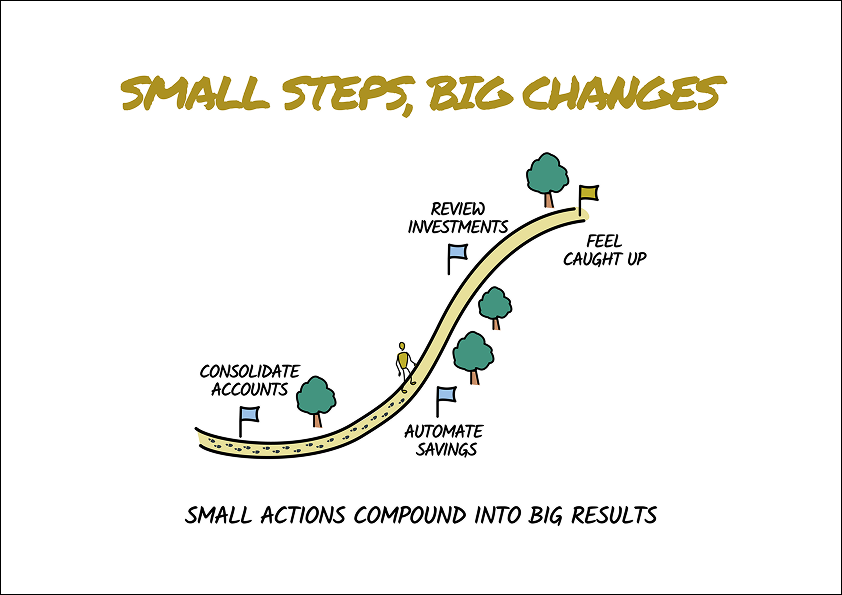

We suggest that you approach financial fitness the same way you'd approach physical fitness. You wouldn't expect to go from sitting on the couch to running a marathon overnight. That would be unrealistic and probably leave you injured or discouraged.

Instead, you'd start with small, manageable steps. You’d start with a 10-minute walk around the block. Then 15 minutes. Then, you’d add some stretching. Before long, those small actions compound into something significant.

Your finances work precisely the same way. The goal isn't to become perfect overnight. The goal is to start moving in the right direction and stay consistent. Small steps compound quickly when you stick with them. We make starting harder in our minds than it needs to be.

Keep Moving Forward

Sometimes work demands everything you have. Sometimes family needs take priority. Sometimes you're dealing with health issues or other challenges that push financial planning to the back burner.

That's completely normal. However, just because you've fallen behind doesn't mean you're stuck there permanently.

Fortunately, you don't need to overhaul your entire financial life in one weekend. You need to take the next right step. Even small actions create forward movement.

Remember, slow progress beats no progress every time. The person who saves an extra £50 per month for five years will be in a dramatically different position than the person who kept meaning to "get organised" but never started.

Your Seasons of Improvement

We see a common pattern with our clients. They make a few improvements, let those changes settle in, then tackle the next area.

You might start by consolidating those old pension accounts scattered across previous employers. This simple step often reduces fees and makes your investments easier to monitor. Once that's organised, you might increase your monthly savings by setting up an automatic transfer. After that becomes routine, perhaps you review your investment allocation.

These aren't dramatic changes, but they add up quickly. When you consolidate accounts and create clear systems, you gain mental clarity. You start to feel "caught up" rather than constantly behind. This confidence often motivates further improvements.

Your Journey Forward

We've learned from working with many families that a few short seasons of focused improvement can completely transform your financial position. We've seen people go from feeling hopeless about retirement to feeling confident about their future, often in just two to three years.

If you're feeling behind or overwhelmed, take heart. Small, consistent actions compound faster than you expect. The next few years could look dramatically different if you start moving forward today.

We're here to guide you through this process. Whether you need help consolidating accounts, increasing your savings rate, or getting organised, we can show you the way forward. The first step is often the hardest, but it's also the most important. Are you ready to take it?

The value of investments and any income from them can fall as well as rise and you may not get back the original amount invested.

Published 01.10.2025